Becoming an Owner-Operator: Securing a Truck Loan

If you want to become an owner operator, before you start your search for the right truck, you need to determine the best way to pay for it based on your own personal situation. Taking care of this step first will help you identify what you can afford and narrow down your search, saving you time.

As we discussed in our truck financing overview post, the two main options are leasing or purchasing (either buying the truck outright or securing a truck loan). Understanding and calculating the internal rates of return of a lease and a purchase can be tricky, and it’s always a good idea to seek the help of a professional who can help you decide which path is best for you and your long-term goals.

no matter how you finance it, a truck is expensive

Given the cost of either new or used trucks, you will need substantial funds to buy a truck outright. If you have the capital, there are certainly benefits to utilizing this option, such as not taking on any debt or the associated interest cost. However, there are times when you are better off keeping funds available for other expenses such as truck repairs or rising fuel prices, and securing a truck loan will allow you to do that. In addition, your revenue will fluctuate depending on the economy and whether or not the truck is being fully utilized (such as needing time off to complete repair work or to take a vacation).

A truck loan will also build equity faster than a truck lease. And ownership is immediate, subject to the lenders’ lien, after all payments are completed - there is usually no final balloon payment. In addition, you can write-off depreciation and there are no mileage limits or overage charges. Typically, a truck loan will be more cost effective overall than a lease. However, a truck loan requires a larger down payment and may have stricter credit requirements, larger monthly payments, and potentially less flexible terms.

Am I eligible for a truck loan?

The most important qualifications for securing a truck loan include:

- a strong credit history

- down payment funds

- access to operating funds

- a CDL (including driving experience)

- a truck that meets the lender’s criteria

- a company approval to lease the truck on

At the end of the day, lenders are looking to mitigate the risk involved with offering truck loans. The older the vehicle, or the more miles it has, the higher the risk for the lender. As such, some lenders will not provide loans for 10+ year old trucks or trucks with more than 700,000 miles. Much like a home mortgage, the maximum amount a lender is willing to lend is typically a percentage of the value of the truck. For example, First National Bank in Sioux Falls will finance up to 85%.

where can I get a loan?

Truck loans are available from banks, credit unions or finance companies. Banks typically require a very strong credit history and a proven revenue stream, but often have favorable loan terms. The overall process when using a bank can take longer and typically requires more documentation before you can get approved for a loan. Finance companies typically have less paperwork and credit hurdles, as well as a faster turnaround time frame. Finance companies are often a great choice for first time truck buyers who don’t have an established business track record.

The best advice we can give is to connect with a financing company who cares enough about you to do what’s best for you and wants to make you successful.

Do your research, compare lenders and their terms, and really get to know your new business partner. If they have your best interest at heart you should listen to what they have to say, even if it’s not what you want to hear. It is extremely important to look at this process as relationship building for your business. Be aware of predatory companies which are looking to take advantage of you.

how much do I need for a down payment?

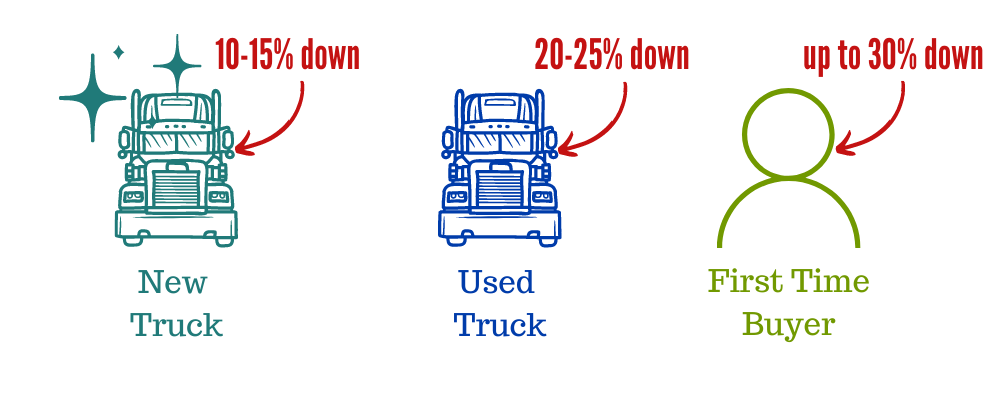

While terms vary across lenders, most require a down payment of 10-15% of the purchase price of a new truck, and up to 20-25% the price of a used truck. Some may even require up to a 30% down payment for first time buyers.

Some lenders may offer no-money-down loans, but you will need very good credit to be eligible and you may end up paying more overall throughout the lifetime of the loan with interest.

what are the credit score requirements?

When starting a trucking company your credit score is your reputation. Typically, the higher the credit score, the better the rates and terms will be. You will need a credit score of at least 600, and some lenders’ minimum credit score requirements may be even higher. Finance companies will usually take your score and adjust down payments and interest rates higher to compensate for poorer scores, while banks can be more willing to look at your entire financial picture.

If your credit score is prohibiting you from getting the package you need, or prohibiting you from getting a loan at all, you can take some time to work on building it up before purchasing your first truck. Some ways to do that are by paying down account balances, making on time payments, and limiting how often you apply for new accounts.

what documentation is necessary to apply?

Requirements will vary by lender, but having all of the following information available (if applicable) will speed along the loan approval process:

- Application including current personal financial statement

- Projected income and expense

- Tax returns (up to 3 years)

- Current Commercial Driver’s License (CDL)

- 2-3 references

- Current contact information

- Any business licenses or required certifications

- United States Department of Transportation (USDOT) number

- Co-signer Statement (if you have poor credit)

In addition, to finalize the loan you will need:

- Truck purchase quote (including title and vehicle registration, mileage, guarantee of title, condition report, and photos of the vehicle you wish to finance)

- Insurance pre-approval (primary liability coverage, physical damage coverage, bobtail coverage for non-trucking use, cargo coverage, etc.) with at least a $1,000 deductible

how much will insurance cost?

Insurance rates can vary depending on the value of both the vehicle and the cargo being hauled, as well as your driving record and any prior claims.

what are typical interest rates?

It depends on your specific truck, qualifications, and lender, but interest rates are typically fixed rates between 4% and 30%. A smaller interest rate will likely only be available to someone with excellent credit and a good personal financial statement. If you find you are only being quoted high interest rates, you may want to reconsider taking on a truck loan at the time and focus on improving your financial situation to set yourself up for success later.

how long are the loan periods?

They typically range from 3 to 5 years.

are there any fees?

Financing companies often charge fees for applications, credit checks, and appraisals (to evaluate the truck’s fair market price), which can significantly impact the cost of your loan. Make sure you ask your lender to disclose any fees that will be assessed, such as prepayment penalties.

how do loan terms impact overall cost?

While truck prices can vary greatly (new/used, specifications, etc.), let’s assume the cost of a new truck is $150,000. If you have a five-year term, a down payment of $15,000 (10%), and an interest rate of 5%, you can expect a monthly payment of $2,500. At the end of the loan term, you will have paid approximately $18,000 in interest.

It’s very important to run the numbers and look at what you can afford monthly as well as the overall cost of the loan(including interest and fees) before determining the best loan terms for your situation. Any monthly payment exceeding $2,750 may impact the chances for success. Higher monthly payments may work for those with lower overall payments and living expenses or those who have an additional income source such as a working partner.

Check out our earlier article for 6 tips on how to start a trucking company.

make sure you understand the agreement terms

Regardless of which lender you choose, it is essential to make sure you understand all the terms of the agreement before you sign anything. If you need help understanding your lease contract, hire a professional to read and explain it to you. Better to pay someone to advise you now than to end up paying huge penalties later. And do not feel pressured into making a decision if you are not 100% comfortable with the agreement. If you find yourself with only one option - and that option is not great - you should reconsider purchasing a truck at this time.

At the end of the day, your truck is your primary asset and it is crucial to take the time to determine the best way to finance it based on what’s best for you.

Are you ready to take the leap and learn more about K&J Trucking check out our frequently asked questions by clicking below!